On sales, purchase and invoice

Automatic and adjustable

On sales, purchase and invoice

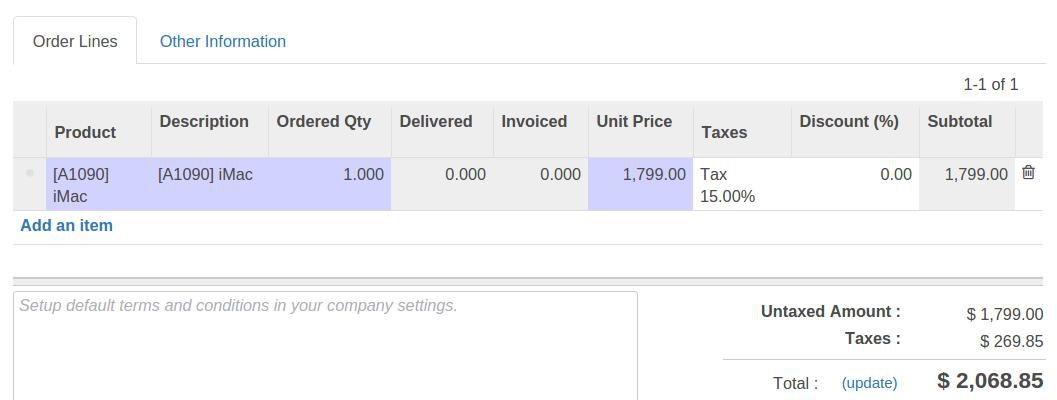

When you add a product on a Sales Order, Purchase Order or Invoice, the system will automatically add the product purchase or sales tax.

This tax is not added to the Subtotal but at the end of the document just above the total.

The tax automatically selected depends on product configuration, customer and fiscal position.

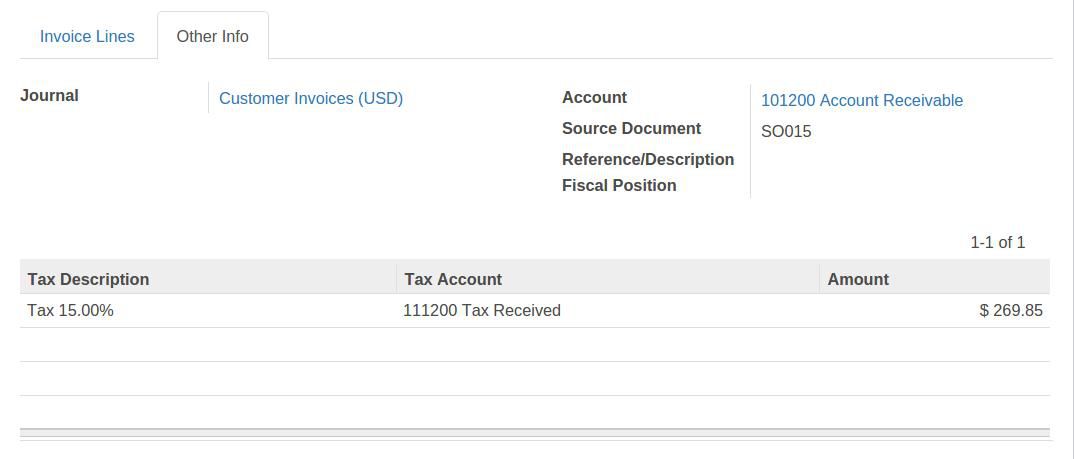

Tax details

Can be seen on the second tax of the invoice. Particularly relevant if there is several types of tax.

Tax Account will be used by the Accounting Entry to book the tax amount

Exception for some orders, invoices or partners

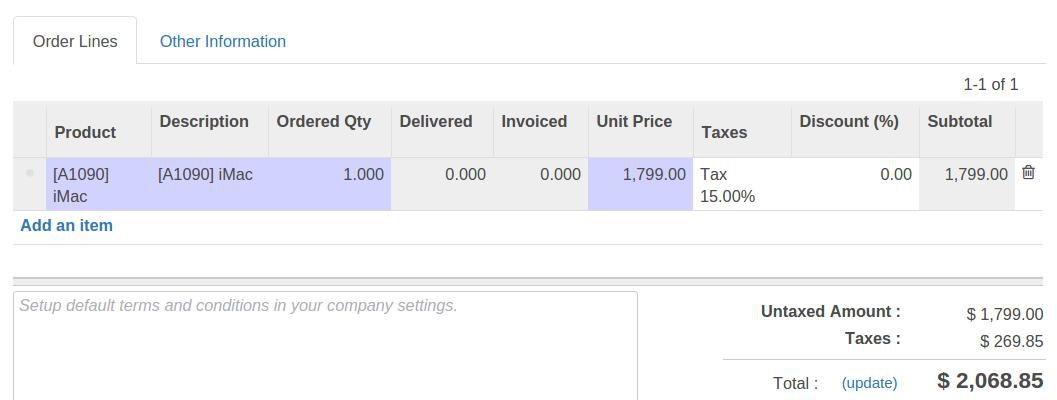

The default tax is set by product, but in some scenario you would like a different tax applied for a specific Customer, Sales or Purchase.

To have special tax for some sales, purchase, invoice or customer you have 3 options.

1 - Change manually the tax on the order/invoice line.

2 - Select another fiscal position

3 - Configure the partner to have another default fiscal position

Fiscal position

To configure a specific tax environment

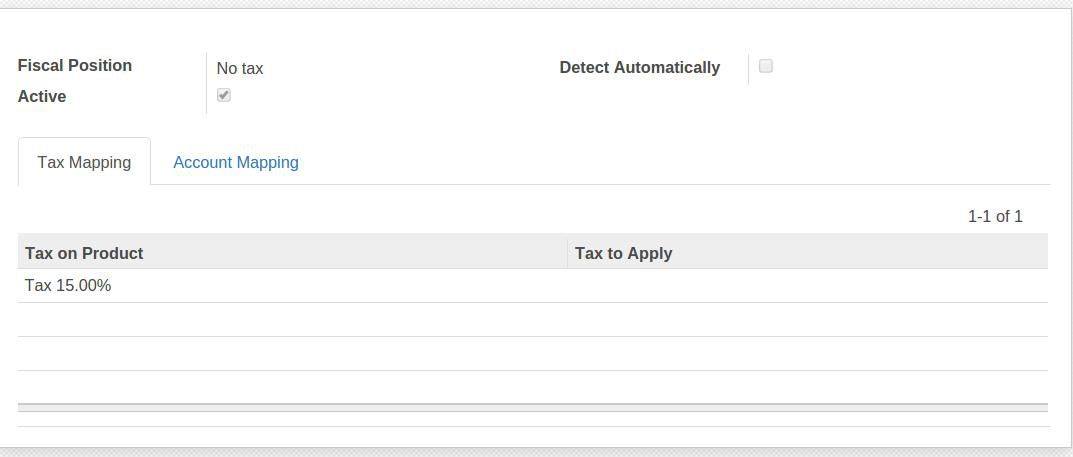

Define your fiscal position

For a specific tax environment (depending on the region, which who you trade, etc.) you would like not to apply some tax OR to replace a tax by another.

A fiscal position allow you to configure this mapping.

In this example we replace the default tax of 15% by no tax.

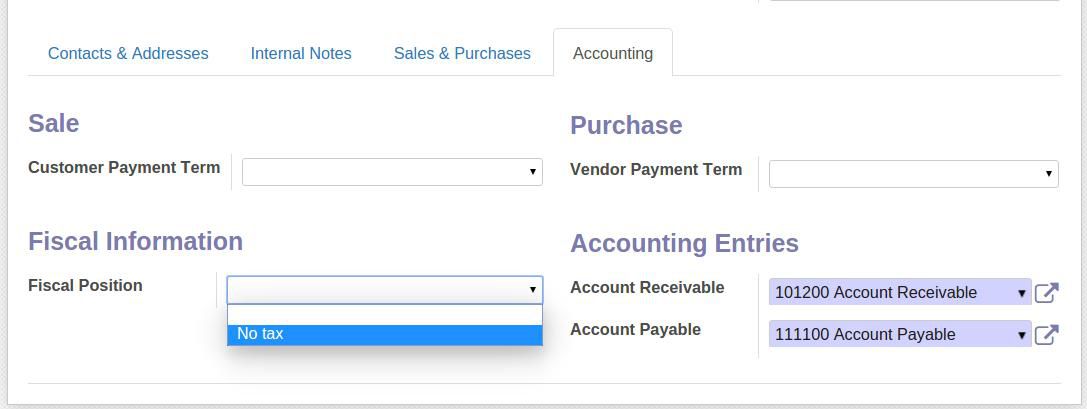

Fiscal position per customer

If you would like to always apply a specific Fiscal position for some customer, you can define it on the customer form.

It is relevant for customers in special areas or industries.

Some customer have tax charged on the top

Everyone pay tax, but different computation

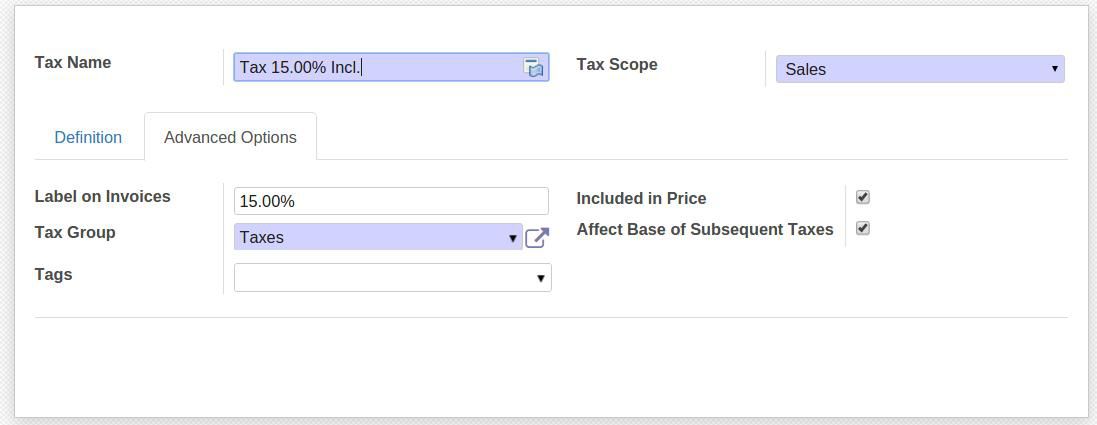

Configure a new tax

Our case it that some customer will be charge the tax on the top of normal price, while other will have the tax included in the sales price.

Customer A buys 1 x 10$ + 1$ tax

Cusomer B buys 1x 9.09$ + 0.91$ tax

We should first define a new tax where the price is included in the price.